Lump sum off mortgage calculator

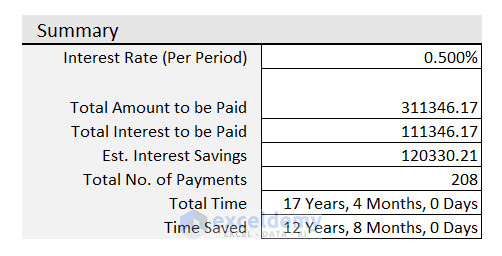

Youll save a total of 3489061 on interest charges and youll pay off your loan within 23 years and 6 months. Our mortgage overpayments calculator will show you how much interest you could save by making regular overpayments each month.

Mortgage Calculator With Extra Payments Payment Schedule

Build Your Future With A Firm That Has 85 Years Of Investing Experience.

. You decide to make an additional 300 payment toward principal. You might be surprised by how much impact can. Calculate how much lump sum payments on your mortgage can help you save by using our.

If you used a 10000 lump sum to pay down your mortgage youd shave off 10 monthsand 13500 in interestfrom your original payment plan. Lump sum repayment calculator Lump sum repayment. Find Out If You Qualify Now.

Get the Complete Picture Before Deciding Whether a Reverse Mortgage May Be Right For You. For example lets assume you have 50000 in student loans at a. With just 200 per month you removed 6 years and two months off your.

This home loan repayment calculator lets you calculate the savings benefits of additional lump sum repayments on your home loan. Top-Rated Mortgage Rates 2022. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

Simply enter the original loan term how many years you have remaining on the loan the original mortgage amount the interest rate charged on the loan the amount you would like to add as. This mortgage payoff calculator can help you find out. Once the user inputs the required information the Mortgage Payoff.

Your monthly payment also stays the same at 139787. See How Much You Can Save. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

You can pay more than your normal repayments off your mortgage with an extra monthly payment or a lump sum payment or both. You can apply a lump sum toward your principal and the bank will. Our extra and lump sum payment calculator helps you see how much you could save by making extra repayments or by making a one-off lump sum payment.

The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. Ad Compare Lowest Mortgage Lender Rates Today in 2022. NerdWallets early mortgage payoff calculator figures it out for you.

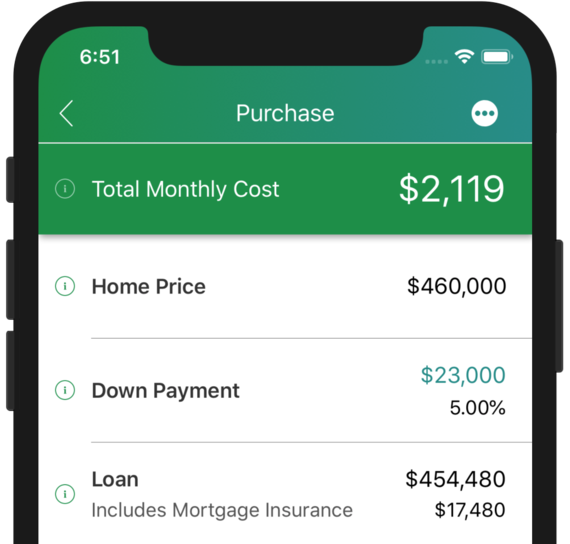

It is a loan and you must be 62. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. To learn what your monthly payment will be based on your home price.

Extra mortgage payments calculator If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you. Ad Reverse Mortgage Facts. To help calculate what it takes to pay off your mortgage use this calculator.

Get Top-Rated Mortgage Offers Online. Own your home sooner by paying more off your mortgage. Loan Information Loan balance Interest rate Monthly payment Lump sum payment Printer.

Fill in the blanks with information about your home loan then enter how many more years you want to pay it. Learn the alternatives to your pension plan. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster.

Loan details Loan Amount Max. How Much Interest Can You Save By Increasing Your Mortgage Payment. RESULTS QA Do you know your current loan balance.

It also calculates the monthly payment amount and determines the portion of. Calculating Your Potential Savings If you have a 30-year 250000 mortgage with a 5 percent. Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa. Use this calculator to compare the numbers and determine how much you can save.

Current Balance Remaining Terms Months Interest Rate APR Additional. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the. Get the facts your free guide today.

While you keep paying the. Based on the above example adding a lump sum payment of 50000 reduces the principal to 250000.

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Extra Payment Mortgage Calculator For Excel

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Purchase Calculator Canadian Mortgage App

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Loan Calculator That Creates Date Accurate Payment Schedules

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Home Mortgage Payment Calculator Using An Excel Spreadsheet

Mortgage Calculator Money

Mortgage With Extra Payments Calculator

Mortgage Payment Rate Calculators True North Mortgage

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

How To Use A Mortgage Calculator Comparewise

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template